capital gains tax increase canada

For the past 20 years capital gains in Canada have been 50 taxable. Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen.

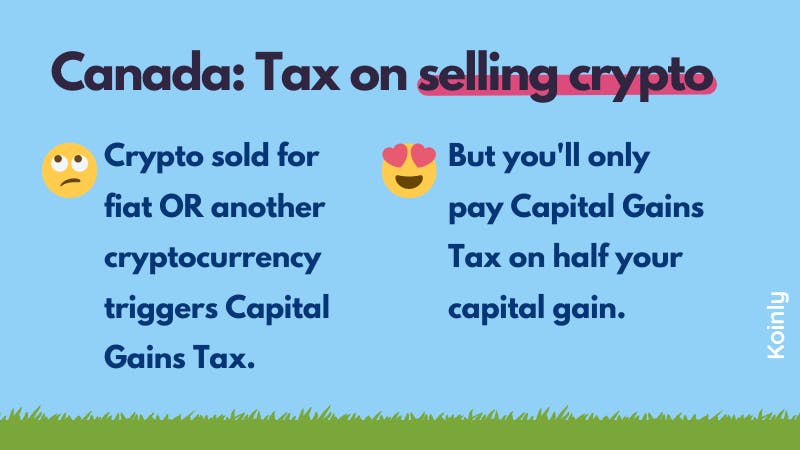

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50.

. Capital Gains Tax Rate. By Amir Barnea Contributing Columnist Sat. NDPs proto-platform calls for levying.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. In all Canadians realized 729 billion in taxable capital gains. The federal budget date has not yet been announced but if a change is.

Raising the capital gains tax would soak more than just the rich new analysis suggests. And the tax rate depends on your income. You cannot use an RFL to create or increase a capital loss from selling farmland.

You sell the condo in 2022 for 250000. New research out this week from the Fraser Institute suggests tax hike would be economically damaging. Tax on capital gain 5353 b 10706 16059 0 0 Tax savings from 5041 donation tax credit c 25205 25205 25205 25205 Total cost of donation a b c 35501 40854 24795 24795.

In Canada 50 of the value of any capital gains are taxable. Election platform the NDP proposed to increase the capital gains inclusion rate to 75 from 50. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income.

In Canada 50 of the value of any capital gains are taxable. When the tax was first introduced to Canada the inclusion rate was 50. The capital gains inclusion rate refers to how much of a capital gain is taxable.

The basic formula for calculating capital gains is the following. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues.

If these rules apply to you you may be able to postpone paying tax on any capital gains you had from the transfer. Capital gains x 50 Inclusion rate x Your personal tax rate Capital gains owed. With Ottawas huge deficit due to the pandemic there is no better time to increase the capital gains tax inclusion rate to 75 writes Amir Barnea.

The Chrétien and Martin Liberals reduced the capital gains inclusion rate the amount of capital gains subject to tax from 75 to 50 as part of a larger initiative to improve Canadas competitiveness and attractiveness to investors. For instance if you earn 80000 taxable income in Ontario and you sold a capital property in BC with a total capital gain of 1000 you will pay 15740 in capital gains tax based on the capital gains tax rate of 1574 in Ontario. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

There has been some desire from federal parties to increase the capital gains inclusion rate to 75 or higher. Of the total 546 percent was declared by taxpayers with incomes over 250000. This depends on your personal tax rate which is based on your personal marginal tax rate for the province you live in which.

This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years. In Canada the capital gains inclusion rate is 50. More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000.

Well be watching closely. A capital gains tax increase would be a form of annual wealth tax that would be. While history doesnt always repeat.

In 1990 for instance the Conservative government raised the capital gains tax to 75 with the Liberal government returning it to 50 in the years after. If this were to happen the benefit of earning capital gains instead of income would be reduced. This is the capital gain.

After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on. You buy a condo in 2020 for 200000. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the upcoming federal budget.

The increase in value is 250000 200000 50000. Canadas top capital gains tax rate 27 per cent is currently above the average for countries in the Organization of Economic Co-operation and. Some of the more common transfers are noted below.

Capital gains tax. He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. Its taxed at your marginal tax rate just like any other income.

Capital Gains 2021. For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to refer to capital gains as. If you sell a property for more than you bought it for you will be taxed on 50 of the difference in value.

It was then increased to 6667 per cent in 1988 and then to a high of 75 per.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Do Taxes Affect Income Inequality Tax Policy Center

Capital Gains Yield Cgy Formula Calculation Example And Guide

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Capital Gain Integrity

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Rate In Canada Keeping It Simple Genymoney Ca Capital Gains Tax Capital Gain Real Estate Investment Trust

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)